Customer loyalty is one of the most important variables for retailers to consider when forecasting revenue, but in this post-covid environment where consumers are looking to tighten their wallets, seeking out competitive deals trumps any pre-existing loyalty.

In this blog, we’re going to take a deep dive into the survey results of Purple’s consumer research report ‘Retail. Not Dead, Just Different’ and reveal how everyday consumers’ shopping behavior, and the impact of retailers providing reward programs.

Where do consumers prefer to shop?

In this section, we asked survey respondents to tell us what channels they have used for their retail goods and necessities over the past 12 months. The response we saw was heavily one-sided with all 3 regions doing the majority of their shopping in-store.

US

Consumers in the United States had a larger amount of consumers preferring to do their retail shopping in-store rather than online. 92% of respondents said in the last 12 months that they have shopped in-store vs 81% have shopped online.

How have consumer shopping trends in the US changed across retail types?

Big box retail in the US

The majority of respondents (39%) in the US stated no change in their shopping habits, however, 35% have shopped online in the last 12 months compared to 26% increasing their in-store shopping.

Fashion retail in the US

Fashion & apparel retailers saw a large shift in consumer behavior. Influenced by the pandemic, 51% of consumers increased their use of e-commerce to make purchases compared to a 17% increase in consumers shopping in-store.

32% of respondents stated their shopping behaviors had not changed in the last 12 months.

Consumer changes for grocery retailers in the US

Grocery retail in the US saw 42% of respondents buying groceries through online channels more frequently, while 24% stated they increased visits to physical stores to make purchases.

34% of consumers say their preferences have not changed with 60% making at least one trip for groceries per week.

UK

Respondents in the United Kingdom showed the highest percentage of shoppers utilizing both physical and e-commerce channels. We identified that 92% of respondents have shopped in both physical and online retail spaces in the last 12 months.

How have retail shopping trends changed in the UK?

While in-store shopping is clearly the preferred method for UK consumers, we have identified a rapid growth in the use of online shopping across all retail sectors.

Big box retail in the UK

Big box retailers in the UK didn’t see a large shift in behavior with 51% of respondents stating their habits have not changed in the last 12 months.

However, in comparison with the US, big box retailers in the UK also had a greater number of consumers utilizing e-commerce. 34% of shoppers stated they now shop online more frequently, and 15% have increased their in-store shopping.

Fashion retail in the UK

As seen in the US market, fashion & apparel retailers in the UK had a large increase in online shopping with 61% of consumers increasing their use of e-commerce vs a smaller increase of 13% making more frequent in-store purchases, and 26% showing no change in their shopping behavior at all.

Grocery retail in the UK

48% of shoppers have increased their use of e-commerce channels since the end of the pandemic. We were also able to see that 24% of respondents are shopping in-store more than online and 28% say their preferences have not changed.

Despite the great increase in online consumption for the UK grocery sector, 69% of respondents stated they shop in-store at least once a week highlighting the importance of grocery venues to everyday consumers.

Mexico

As the region most impacted by on-again off-again lockdown measures, we have identified that Mexican consumers have the largest disparity between the retail channels used when shopping for groceries. Over the last 12 months, 95% of consumers in Mexico have shopped in-store, while 73% have shopped online.

How have retail shopping trends changed in Mexico?

Big box retail Mexico

Survey respondents in Mexico have revealed that the big box sector in this region saw the greatest increase in online and offline shopping when compared with big box retailers in the US and UK. 38% of consumers have increased their use of e-commerce post-pandemic and 30% are more frequently shopping in-store. We have also witnessed that 32% of consumers have had no change in their big-box shopping preferences.

Fashion retail in Mexico

Following the same trend seen in the US and UK, fashion & apparel retailers in Mexico gained a majority increase in e-commerce purchases with 57% of consumers stating they shop more frequently online. In comparison, 22% of respondents have increased their in-store trips, revealing that physical stores are still a necessity in this region.

This in turn signifies 21% of respondents showed no change in behavior, utilizing both online and offline channels at the same level when compared to the pre-covid environment.

Grocery retail in Mexico

Since the pandemic, Mexico has seen the greatest increase in online shopping adoption with 55% of consumers using e-commerce channels for their grocery purchases. Despite this increase, 23% of consumers have begun visiting in-store more frequently, while 22% have had no change in their shopping preferences.

Consumers are looking for a blended shopping experience

From the data seen above we can identify that in all 3 global markets, shoppers aren’t having to choose between shopping online or just offline, they’re looking for a mix of both. With all 3 regions having similar percentages for in-store shopping and no change in preference it’s clear that e-commerce is evolving to become a part of a larger consumer journey of unified commerce.

Are retailers actively promoting reward programs?

As mentioned at the beginning, due to the current financial climate consumers are increasingly on the lookout for ways to cut costs and make the most of timely bargains. In this section, we’re going to identify whether retailers are doing enough to promote their reward programs, and the effect it will have on customer loyalty.

Are retailers promoting reward programs in-store?

With in-store shopping being the primary choice for consumers, retailers must make the most of every opportunity to promote their reward programs and the potential benefits consumers can reap when they sign up.

The following statistics show on average, how often consumers are told about reward programs when in-store.

13% of consumers are never told about reward programs when in-store

48% of consumers are occasionally told about reward programs when in-store

27% of consumers are told about reward programs most of the time when shopping in-store

12% of consumers are told about reward programs every time they visit in-store

From this data, we can see that when consumers are in-store, retailers aren’t fully seizing the opportunity to increase customer loyalty through reward programs.

Are retailers promoting reward programs online?

19% of consumers are never told about reward programs when shopping online

47% of consumers are occasionally told about reward programs when shopping online

23% of consumers are told about reward programs most of the time they shop online

10% of consumers are told about reward programs every time they shop online

Similarly to when consumers shop in-store, retailers are missing a great opportunity to promote reward programs through online shopping channels.

As consumers continue to adopt e-commerce alongside visiting physical stores, retailers must take the opportunity to link online and offline shopping, promote reward programs, and boost customer loyalty.

How important is it for retailers to promote reward schemes?

After looking at the frequency with which retailers are promoting their reward programs, let’s see if they are meeting consumer expectations.

In the US, 66% of consumers are already members of at least one active retail reward program membership with 63% of surveyed consumers saying it is important for retailers to promote reward programs.

On average 52% of UK consumers already have at least one active reward program membership, and 69% of surveyed consumers feel it is important for retailers to promote their reward programs. Introduced in 1995 the Tesco Clubcard was the first nationwide supermarket loyalty card influencing UK consumers to become greatly receptive to the idea of reward programs with 81% of consumers surveyed stating they were part of a grocery retail reward program.

With the highest expectation of all 3 regions, 76% of consumers in Mexico feel it is important for retailers to promote reward programs, however, only 47% of consumers have an active reward program membership. This disparity between consumers’ expectations and the availability of reward programs is likely to negatively affect customer loyalty.

How can retailers influence reward program adoption in-store?

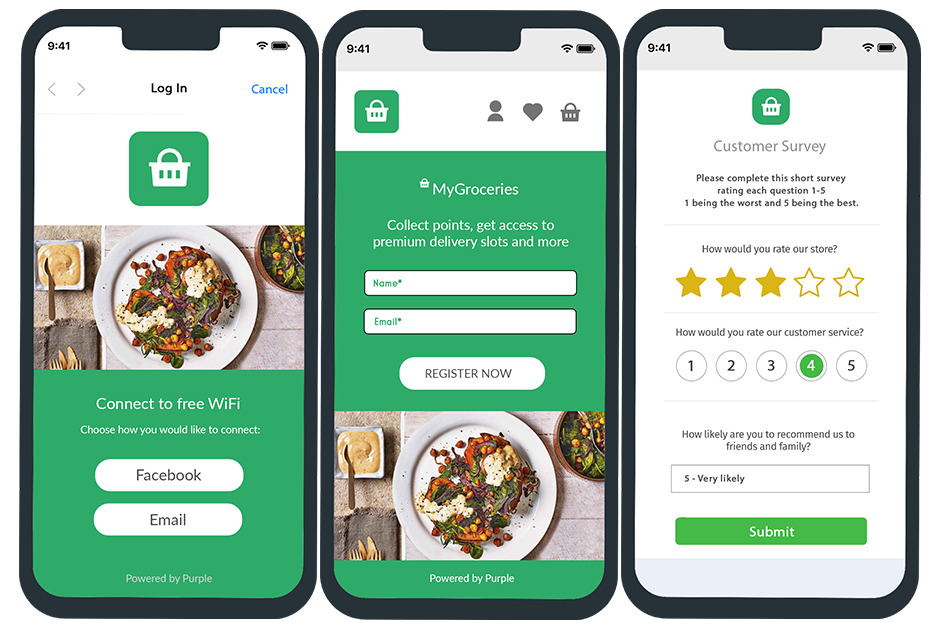

Utilize existing WiFi

Free guest WiFi is an expectation in every public venue with 71% of consumers saying they will access it when in-store. Despite this fact, businesses continue to fail to gain any benefit in return for this service.

By enhancing existing WiFi infrastructures with captive portal access journeys retailers can promote their reward programs to all users who log in.

Real-time offers

While it’s possible for offers to be delivered through print-out advertisements they quite often can miss the mark when encouraging visitors to buy. Why? Because they’re not personalized or delivered in real time.

By enhancing the existing WiFi infrastructure to collect demographic information, retailers can segment data to influence in-store purchases by keeping offers personalized. When using this tool, retailers can promote additional personalized offers only available by signing up for existing reward programs.

64% of consumers state the offers they receive influence their loyalty when choosing where to shop.

How can retailers influence reward program adoption online?

Other than the online advertising options that are available to all businesses, let’s see how retailers can directly influence their customers to sign up for reward programs post-visit.

Personalized messages through Email and SMS

The customer data collected when logging into the guest WiFi enables retailers to deliver timely notifications post-visit through automated email and SMS comms, keeping offers and promotions top of mind.

By automatically segmenting collected data to understand their most receptive audiences and encourage them to sign-up to reward programs, retailers can increase return rates by up to 24%!

Making the most of every customer interaction is vital to improving customer loyalty.

What’s next for the retail sector?

Retail business will always be a necessity, but customer loyalty has never been more important for survival. Retailers must shift their focus and put the customer experience first, and the main ways to achieve this are through personalization and customer loyalty.