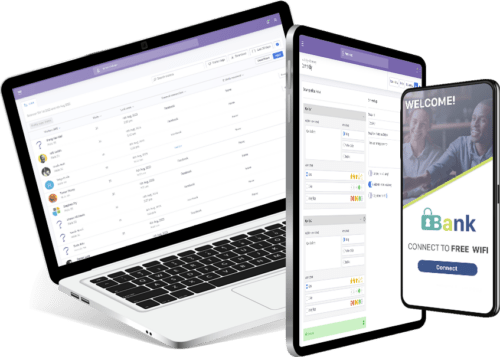

WiFi for Retail Banking

We work with some of the world’s largest financial institutions to provide secure, stable and scalable WiFi for their retail banks

99.99% uptime

ISO accredited certification to 27001 and 9001

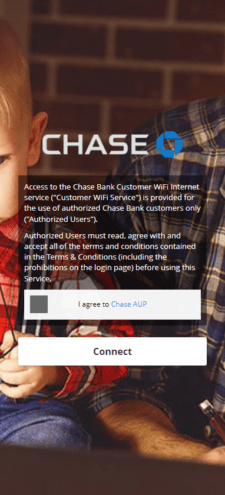

Compliant with all global data and privacy regulations

We onboard millions of users onto WiFi each day

Network performance

74% of IT professionals state that user complaints about network performance are the most common issue they face

74%

Data compliance

86% of IT professionals consider compliance with data privacy regulations as a top concern when managing guest WiFi

86%

WiFi compliance

43% of IT professionals said that compliance was their biggest challenge with a guest WiFi network

43%

Scalable guest WiFi currently offered in over 60,000 venues

We look after your Guest WiFi, you focus on core activity

From 1 to 1million access points, we can scale no matter the number of venue

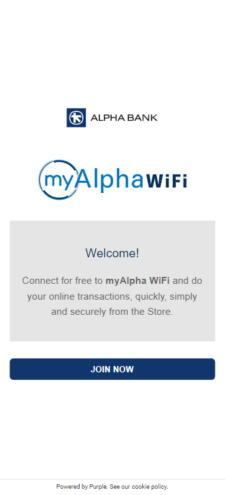

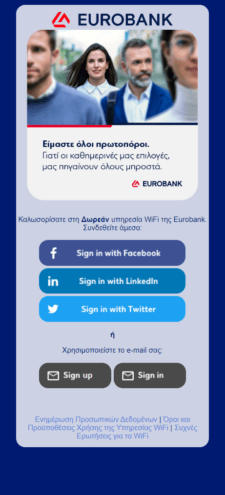

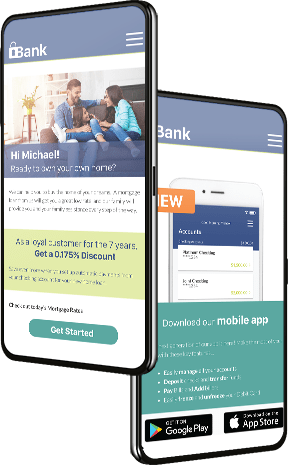

Offer a consistent user and brand experience

Accept terms and conditions once only

Highly secure for peace of mind

99.999% uptime

ISO 9001 and 27001 accredited certification

Highly secure platform

Dedicated SRE team to handle critical issues quickly and efficiently

Effectively display important messages and available services

Use your WiFi access journey to advise and educate your customers

Include ads as part of your access journey

URL redirects

Option to capture marketing opted-in contact information

How do you compare with other banks?

Our new Banks Industry Benchmark Report analyzes data from more than 32,000 locations to give you valuable insights. Download to see how you compare.