Customer loyalty is one of the most important variables for grocery retailers to consider when forecasting expected revenue. But in this post-covid environment where consumers are looking to tighten their wallets, seeking out competitive deals trumps any pre-existing loyalty.

In this blog, we’re going to take a deep dive into the survey results of Purple’s consumer research report ‘Retail. Not Dead, Just Different’ and reveal how everyday consumers’ shopping behavior, and the impact of grocery retailers providing reward programs.

How are consumers shopping for groceries?

In this section, we asked survey respondents to tell us what channels they have used for their groceries over the past 12 months. The response we saw was heavily one-sided with all 3 regions doing the majority of their grocery shopping in-store.

US

A larger amount of consumers in the United States prefer to shop for groceries in-store rather than online. 88% of respondents said in the last 12 months that they have shopped in-store vs 53% have shopped online.

How have grocery shopping trends changed in the US?

The grocery shopping trends witnessed in the US following the pandemic show a similar trend to that of the UK. 41.6% of respondents are more frequently buying groceries through online channels, 24.1% are regularly visiting physical stores to make purchases, and 34.3% say their preferences have not changed.

UK

The United Kingdom showed the highest percentage of respondents utilizing both physical and e-commerce channels with in-store purchases being the most common at 92% and online having been used by 67%.

This split may have been influenced by the fact that the UK ended lockdown measures earlier than the other surveyed regions.

How have grocery shopping trends changed in the UK?

While shopping in-store is clearly the preferred method for UK consumers, we have identified a rapid growth in the use of online shopping with 48% of respondents having increased their use of e-commerce channels since the end of the pandemic.

We were also able to see that 24% of respondents are shopping in-store more than online and 28% say their preferences have not changed.

Mexico

As the region most impacted by on-again off-again lockdown measures, we have identified that Mexican consumers have the largest disparity between the retail channels used when shopping for groceries. Over the last 12 months, 78% of consumers in Mexico have shopped for groceries in-store, while 46% have shopped online.

How have grocery shopping trends changed in Mexico?

Since the pandemic, Mexico has seen the greatest increase in online shopping adoption with 55% of consumers using e-commerce channels for their grocery purchases. Despite this increase, 23% of consumers have begun visiting in-store more frequently, while 22% have had no change in their shopping preferences.

Consumers are looking for a blended shopping experience

From the data seen above we can identify that in all 3 global markets, shoppers aren’t having to choose between either shopping online or just offline, they’re looking for a mix of both. With all 3 regions having similar percentages for in-store shopping and no change in preference it’s clear that e-commerce is evolving to become a part of a larger consumer journey of unified commerce.

Are grocery retailers actively promoting reward programs?

As mentioned at the beginning, due to the current financial climate consumers are increasingly on the lookout for ways to cut costs and make the most of timely bargains. In this section, we’re going to identify whether grocery retailers are doing enough to promote their reward programs, and the effect it will have on customer loyalty.

Are grocers promoting reward programs in-store?

With in-store shopping being the primary choice for consumers, grocery retailers must make the most of every opportunity to promote their reward programs and the potential benefits consumers can reap when they sign up.

The following statistics show on average, how often consumers are told about reward programs when in-store.

13% of consumers are never told about reward programs when in-store

48% of consumers are occasionally told about reward programs when in-store

27% of consumers are told about reward programs most of the time when shopping in-store

12% of consumers are told about reward programs every time they visit in-store

From this data, we can see that when consumers are in-store, grocery retailers aren’t fully seizing the opportunity to increase customer loyalty through reward programs.

Are grocers promoting reward programs online?

19% of consumers are never told about reward programs when shopping online

47% of consumers are occasionally told about reward programs when shopping online

23% of consumers are told about reward programs most of the time they shop online

10% of consumers are told about reward programs every time they shop online

Similarly to when consumers shop in-store, grocery retailers are missing a great opportunity to promote reward programs through online shopping channels.

As consumers continue to adopt e-commerce alongside visiting physical stores, grocery retailers must take the opportunity to link online and offline shopping, promote reward programs, and boost customer loyalty.

How important is it for grocers to promote reward schemes?

After looking at the frequency in which grocery retailers are promoting their reward programs, let’s see if they are meeting consumer expectations.

In the US, 66.3% of consumers are already a member of at least one active grocery reward program membership with 62.5% of surveyed consumers saying it is important for grocers to promote reward programs.

With 81% of UK consumers already having at least one active reward program membership, 68.5% of surveyed consumers feel it is important for grocers to promote reward programs. With the Tesco Clubcard being introduced in 1995 as the first nationwide supermarket loyalty card UK consumers are greatly receptive to the idea of reward programs.

With the highest expectation of all 3 regions, 75.6% of Mexican consumers feel it is important for grocers to promote reward programs, however, only 41.4% of consumers have an active grocery reward program membership. This disparity between consumers’ expectations and the availability of grocery reward programs is likely to be affecting customer loyalty negatively.

How can grocery retailers influence reward program adoption in-store?

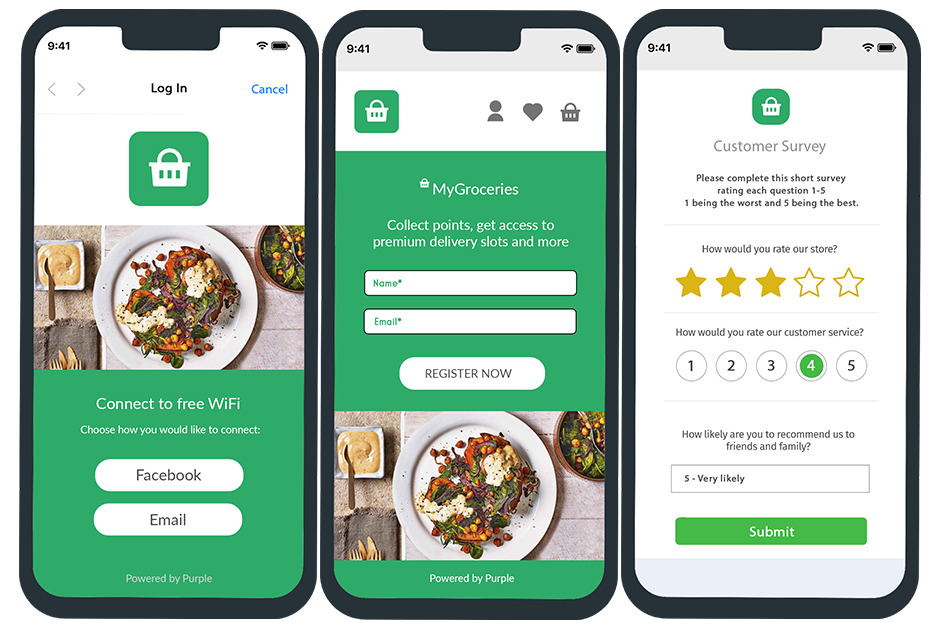

Utilize existing WiFi

Free guest WiFi is an expectation in every public venue with 71% of consumers saying they will access it when in-store. Despite this fact, businesses continue to fail to gain any benefit in return for this service.

By enhancing existing WiFi infrastructures with captive portal access journeys grocery retailers can promote their reward programs to all users who log in.

Real-time offers

While it’s possible for offers to be delivered through print-out advertisements they quite often can miss the mark when encouraging visitors to buy. Why? Because they’re not personalized or delivered in real-time.

By enhancing the existing WiFi infrastructure to collect demographic information, grocery retailers can segment data to influence in-store purchases by keeping offers personalized. When using this tool, grocers can promote additional personalized offers only available by signing up to existing reward programs.

63.7% of consumers state the offers they receive influence their loyalty when choosing where to shop.

How can grocery retailers influence reward program adoption online?

Other than the online advertising options that are available to all businesses, let’s see how grocers can directly influence their customers to sign up for reward programs post-visit.

Personalized messages through Email and SMS

The customer data collected when logging into the guest WiFi enables grocers to deliver timely notifications post-visit through automated email and SMS comms, keeping offers and promotions top of mind.

By automatically segmenting collected data to understand their most receptive audiences and encourage them to sign-up to reward programs, grocers can increase return rates by up to 24%!

Making the most of every customer interaction is vital to improving customer loyalty.

What’s next for grocery retail?

While grocery retail will always be a necessity, customer loyalty has never been more important for business survival. Retailer dedication has to shift and put the customer experience first, and the main ways to achieve this are through personalization and customer loyalty.